June 13 2024

This week’s vote to allow the increase in the inclusion rate for capital gains taxes to go ahead is good news for our health care system and other public services Canadians rely on. The increase is expected to bring in an additional $19.4 billion in revenue over 5 years. When additional funds are desperately needed for services like health care and housing, this is good news.

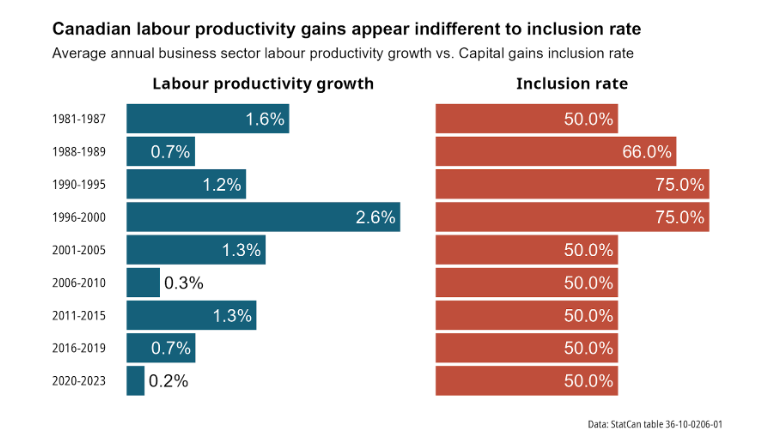

Capital gains only taxed at half the rate of earned income

People who earn their incomes through wages and salaries pay tax on all of their incomes. But only 50% of income from capital gains is subject to tax. That means that the wealthy individuals and corporations who have income from capital gains are able to avoid paying their fair share.

CEOs of gas and oil companies among those benefiting from low capital gains taxes

Because much of their income comes in the form of stock options, wealthy CEOs have done very well as a result of the lower rate for capital gains taxes. That includes the CEOs of the large grocery store chains and oil companies that have been accused of gouging Canadians.

For example, the CEO of Empire Company, who is the owner of Sobeys, Safeway and other chains, received $8 million in stock options in 2020. Galen Weston, who recently stepped down as CEO of Loblaw, owned $42 million in stock options as of March 13, 2023. Between 2021 and 2023, the CEO of Imperial Oil received $16.6 million in stock awards.

Failing to increase the rate for capital gains taxes would mean the CEOs of grocery chains, oil companies, and other corporations that have profited from jacking up the prices would be able to avoid paying their fair share of taxes.

Governments have used lack of money as an excuse for underfunding

One reason tax fairness is so important is that it removes the excuse governments use for underfunding public services — that they can’t afford it. The reality is that whether governments can afford to properly fund the public services people depend on is a choice. If governments are willing to ensure that the wealthy and large corporations pay their share, public services are affordable.

Conservatives prioritize wealthy over our health care

For anyone hoping that the Pierre Poilievre Conservatives can be trusted with health care, the House of Commons vote on capital gains tax is deeply disappointing. Following Budget 2024, the Conservatives avoided commenting on the proposal to increase capital gains taxes. They recognized that the increase would only affect the wealthiest Canadians and the additional revenue it would generate would help all Canadians.

Unfortunately, they have succumbed to the lobbying efforts of the wealthy individuals and corporations that profit from the inclusion rate for capital gains and have come out against the change. The Conservatives have decided that making the very wealthy even richer is more important than the needs of low- and middle-income Canadians.

More needed to make tax system fairer

The tax policies of the Trudeau government should be criticized — but because they don’t go far enough. Even with the changes to capital gains taxes, the inclusion rate for capital gains will still only be taxed at 67% of earned income.

For real tax fairness, more is needed. Measures that would provide the funding needed for vital public services and ensure everyone does their bit include a wealth tax, windfall profits tax, and reversing the cuts to income tax rates on large corporations and the wealthy.

If the Poilievre Conservatives were genuinely concerned about the well-being of low- and middle-income Canadians, they would be pushing for these measures instead of trying to help grocery chain and oil company CEOs get even richer.