February 18 2026

Backgrounder

Contents

- Introduction

- Reconciliation and Indigenous Sovereignty

- Equity, Diversity, Inclusion, and Accessibility

- Gender Equity

- 2SLGBTQIA+

- Disability

- Canada Disability Benefit

- Child Care

- Young Workers

- International Aid

- Conclusion

Introduction

To supplement its federal budget analysis, NUPGE has taken a closer look at how Canada Strong: Budget 2025 scores on measures of reconciliation, Indigenous sovereignty, and measures related to equity, diversity, inclusion, and accessibility.

Reconciliation and Indigenous Sovereignty

It is clear from this budget that this federal government is refusing to fulfill its obligations to Indigenous people, and will continue to fall short on the Calls to Action and Calls for Justice. Indigenous programs will face 2.3 billion in cuts, in total. National Chief at the Assembly of First Nations (AFN), Chief Cindy Woodhouse Nepinak states that she was “disappointed that only a handful of the AFN’s pre-budget priorities were addressed, despite the organization calling for nearly $363 billion in investments to meet the 2030 target”. Similarly, the National Association of Friendship Centres published a statement saying it fears the government will fail to fulfil previous promises.

There was one positive move. Explicit references to free, prior, and informed consent, when it comes to the Building Canada Act (a first for this government) will help ensure Indigenous sovereignty is respected. It is crucial that the Indigenous Advisory Council has significant oversight in their role to ensure their position is not one of tokenization. In addition, Riley Yesno has reported, “as many Indigenous Nations that have been involved in major economic projects… will attest, the process to come to mutually beneficial agreements around these projects often takes a great deal of time, investment in Indigenous-led assessments, and extensive consultation—all of which is not conducive to this accelerated nation-building vision Budget 2025 puts forward.”

However, the government outlines no new funding for an Indigenous Housing Strategy, no long-term commitment to programs such as Jordan’s Principle and the Inuit Child First Initiative. This shows the federal governments’ lack of concern for their obligations under the United Nations Declaration on the Rights of Indigenous Peoples which Canada codified into law in 2021. With the Inuit Child First Initiative expiring in March of 2026, the Inuit Tapiriit Kanatami (ITK) expressed deep concern the federal government had not committed to long-term support and renewal of the program.

Although money is designated to Indigenous Infrastructure, much of this funding is a reannouncement of funds that were expected because of existing claims and rights. In addition, building infrastructure in rural, remote and northern communities will cause harm if not done in consultation, with safety at the top of mind with Indigenous peoples. Without the necessary services and supports, proposed routes to the North are likely to cause the same horrifying femicide as the highway of tears. But there is no funding or commitments for transit or cellular service, and the omission of a red dress alert in the “Renewing Canada’s National Public Alerting System,” is a cause for deep concern that Indigenous women, girls, and 2-Spirit people will be left with the consequences.

The budget does outline renewed funding for the First Nations Water and Wastewater Enhanced Program to maintain progress on existing projects, but does not include funding to prevent or end the 38 existing long-term drinking water advisories. It should be noted that in December 2025, the Federal Court confirmed that Canada has a legal obligation to provide both adequate housing and safe drinking water to First Nation peoples living on reserves.

Equity, Diversity, Inclusion, and Accessibility

Prior to the release of Budget 2025, there were concerns about major cuts to Women and Gender Equality Canada (WAGE). Feminist and 2SLGBTQIA+ organizations and advocates organized to ensure continued funding for WAGE. On October 29, 2025—ahead of the November 6 release of the budget—it was announced that the budget would include $528.4 million over four years, starting in 2026-27, or $132.1 million annually for WAGE. The $132.1 million has been earmarked for the following initiatives:

| Program | Annual amount (for five years, beginning in 2026-2027) |

| Advance women’s equality in Canada | $76.5 million |

| Support the 2SLGBTQI+ community sector | $9.4 million |

| Pride Security | $1.5 million |

| Strengthen federal action on gender-based violence | $44.7 million |

The fact that fund cut for WAGE was not as bad as feared must be considered a win in the current climate. As Queer Momentum states, the funding is still more than the potential 81% cut over three years that was rumoured in the lead up to the budget. However, that win comes with caveats. The first is that the annual funding is significantly less than what it has been in previous years though. The second is that WAGE is still slated for 2% cuts, though we recognize that this is less than the 15% most other departments are facing.

The budget contains two mentions equity, diversity, and inclusion, or anti-racism. The Inclusion, Diversity, Equity and Anti-Racism Secretariat and the Equity Diversity and Inclusion in Sport initiatives are given minimal funding in 2025-2026 and nothing long-term. It should be noted that when discussing public service job cuts, a recent report from the Canadian Centre for Policy Alternatives states that the cuts will disproportionately impact public service workers who are women, Indigenous, racialized, and have disabilities.

There is no mention in the budget of funds or plans for legislation to implement the recommendations from the Report of the Employment Equity Act Review Task Force. The task force’s report was published in 2023 and Budget 2024 stated the previous Liberal government’s intention was to propose legislative amendments to modernize the Employment Equity Act, including by expanding designated equity groups. Consultation on the Employment Equity Act Modernization ran from May to August 2024 with the website stating, “we will use the feedback received during the consultation to inform changes to the EEA. We will also summarize the feedback into a report and publish it online.” To date, no further action has been made public.

Statistics Canada is flagged for 15% cuts over three years. To meet this target, the budget states, “the frequency of data collection will be reduced where the requirements can be met through statistical modelling or other modern methods. In addition, adjustments will be made to the frequency and level of detail collected for data sets which demonstrate less relevance to Canadians.” First funded in Budget 2021, Statistics Canada’s Disaggregated Data Action Plan (DDAP) enabled Statistics Canada to support more representative data collection methods, enhance statistics on diverse populations to allow for intersectional analyses, and support government and societal efforts to address known inequalities and promote fair and inclusive decision-making. Statistics Canada was provided with $172 million over five years to fund DDAP, making the 2025-2026 financial year the final year of initial funding. There is no mention of ongoing funding for DDAP in Budget 2025.

Annex 6: Impact reports – A Stronger Canada Through Diversity states that, “a strength of Canada’s gender budgeting approach is its attention to identifying barriers for women and other underrepresented groups, and integrating mitigation actions into program design to address them”. However, it’s telling that when examining each measure of the budget, 2SLGBTQIA+ and people with disabilities are only listed as receiving direct or indirect benefits from one measure each—and in the case of 2SLGBTQI+ people, the measure is the WAGE funding that was announced prior to the budget release.

In times of austerity and cuts to the public services, women, 2SLGBTQIA+ people, people with disabilities, Indigenous, Black and racialized people are mostly likely to be impacted by both job losses and cuts to services they rely on. True commitment to all Canadians would require significantly more consideration for the ways public services are used by those Canadians.

Gender Equity

The Sexual and Reproductive Health Fund (SRHF) was first funded in 2021 with a $45 million investment. It was renewed with another $36 million investment in the 2023 budget, for a total investment of $81 million between 2021 and 2027. In the Canada Strong campaign platform, Canadians were promised that “a Mark Carney-led government” would make the SRHF permanent. While current funding isn’t set to expire until 2027, Budget 2025 announced permanent funding for other programs but not SRHF. Regardless of its questionable permanency, the SRHF will undoubtably be hurt by the planned 15% cuts over three years assigned to Health Canada.

As per the Canadian Gender Budgeting Act, the federal government must consider gender and diversity in taxation and resource allocation decisions in order to consider how taxation, the allocation of public resources and other policy decisions may produce various impacts on diverse groups, with the potential to create, sustain or reduce inequalities within society. The publication of this analysis ensures proper transparency and accountability for government spending. The imperfect criteria of analysis do not include consideration for gender-diverse people and maintains a man/woman gender binary, and the ways in which the criteria are applied are inconsistent (usually to favour a more gender-balanced analysis).

According to this government’s own analysis of the 155 measures proposed in the 2025 Budget, 25% will specifically benefit men, with only 4.5% of the budget catered specifically to women. In Chapter 1 – Building a Stronger Economy, 13 of the 34 (38%) measures are to benefit a majority of men. In Chapter 2 – Shifting from Reliance to Resilience, 10 of 16 (62.5%) are to benefit a majority of men. In Chapter 4 – Protecting Canada’s Sovereignty and Security, 7 of 17 (41%) will benefit men. The one exception to this pattern is in Chapter 3 – Empowering Canadians with 18.5% of measures benefitting a majority of women, and 7.4% benefitting men, but that claim is easily disproven when looking at the rationale for the government’s analysis. Several measures are listed as moving forward gender equity, but explained in the fine print as benefiting men (e.g. the Launching Build Canada Homes measure).

2SLGBTQIA+

There is a lack of information on how non-binary and gender-diverse people will benefit from budget measures as the budget only categorizes gendered impact based on men, women, and a catch-all 2SLGBTQI+. There is also no mention of any measures to combat rising transphobia.

As part of the pre-budget announcement on WAGE funding, $54.6 million over five years has been designated to support the 2SLGBTQI+ community sector which includes $7.5 million over five years for Pride Security. This amounts to $9.4 million annually and $1.5 million annually, respectively. This is significantly less than what has been provided in past budgets. Additionally, there are no funds earmarked to fulfill the campaign platform promise of establishing a new in vitro fertilization (IVF) program aimed at, “making it more affordable for Canadians who want to become parents, especially 2SLGBTQI+ Canadians who face a costly journey to parenthood”.

Though not directly related to the budget, it should be noted that Kevin Roberts, president of The Heritage Foundation, was invited to speak to Prime Minister Mark Carney’s cabinet in a private meeting in September. The Heritage Foundation—a right-wing think tank that has significant influence in shaping U.S. public policy—is responsible for the infamous Project 2025. Roberts is credited as the architect and driving force behind Project 2025 which is a blueprint for, among other things, restricting democracy, ending DEI initiatives, and eliminating 2SLGBTQIA+ rights (particularly transgender rights). Following the murder of Charlie Kirk, the Heritage Foundation launched a petition for the FBI to add so-called “trans ideology” as a terror threat. Though the meeting ultimately didn’t happen (due to Roberts’ schedule) a spokesperson from the Prime Minister’s office said, “our team will continue further engagement and discussions with him and other leading U.S. policy figures soon, regarding Canada’s economic and security relationship with the United States.”

Disability

Employment and Social Development Canada (ESDC) administer the Opportunities Fund for Persons with Disabilities (OFPD) and the Social Development Partnerships Program – Disability (SDDP-D). The OFPD is a key vehicle for the implementation of the Employment Strategy for Canadians with disabilities.

The OFPD currently funds over 100 projects across Canada with the vast majority being projects that help people with disabilities find and maintain good jobs. The SDDP-D is a grants and contributions program that supports not-for-profit organizations, First Nations, Inuit, and Métis groups, and volunteer sector organizations under the umbrella of benefiting people with disabilities. The SDDP-D provides funding at the national and regional levels.

While Budget 2025 included support for some programs managed by ESDC, it has also tasked it with 15% cuts over three years. Annex 3 makes specific mention of a, “targeted recalibration of its programs and its approach to delivering them,” as well as plans to implement AI, decrease office space, consolidate management and administrative support functions—all of which point to cuts in the public service. The budget also states, “ESDC will decrease funding to underperforming programs and those with limited effectiveness and overlap with other federal initiatives”.

It remains to be seen whether the government believes the OFPD and SDDP-D are valuable enough. However, if the OFPD and SDDP-D are flagged for cuts, Inclusion Canada points out that doing so could violate the United Nations Convention on the Rights of Persons with Disabilities.

Additionally, the Build Canada Homes initiative promises, “affordable and non-market housing [that] will benefit groups in greatest need of affordable housing including…persons with disabilities.” However, it fails to earmark any funding to ensure that the initiative produces homes that are accessible and built using the principles of universal design. Not much is known about the Build Canada Homes initiative yet, but the budget claims it will be a “new federal agency that will drive investment and public-private cooperation”. Given that public-private partnerships (or P3s) are notorious for cutting corners and delivering subpar results, unless the government explicitly states that accessibility and universal design must be incorporated into the new builds, people with disabilities will not sufficiently benefit from the initiative.

Canada Disability Benefit

Budget 2025 recognizes that costs associated with applying for the Disability Tax Credit (DTC)—something that’s mandatory to be eligible for the Canada Disability Benefit (CDB)—can be prohibitive. However, the budgeted one-time supplemental CDB payment of $150 in respect of each DTC certification, or re-certification, falls short of providing meaningful assistance to many people with disabilities.

Depending on the type of disability, a person’s DTC may expire after a certain number of years, requiring people with disabilities to reapply. While some disabilities are temporary, many are not. For example, many parents of children with autism have reported that their child’s DTC expires once they turn 18, despite autism being a lifelong disability. Limiting the supplemental CDB payment to a one-time payment hurts people with disabilities who are forced to apply for the DTC multiple times.

The commitment to bring forward legislation to exempt the CDB from being treated as income under the Income Tax Act is welcome news, although this should have been legislated prior to the start of enrolment in the CDB. When drafting this legislation, people with disabilities and disability organizations (with priority being given to organizations led by people with disabilities) must be consulted.

What’s missing from Budget 2025 is an increase to the CDB that would make a real difference in the lives of people with disabilities. The current maximum amount paid by the CDB is $2,400 a year or $200 per month. This amount fails to lift people with disabilities out of poverty as defined by the government’s own Market Basket Measure. It also fails to reflect the cost-of-living crisis that has worsened since the conception of the CDB, the added costs related to living with a disability, and the feedback from people with disabilities, caregivers, disability organizations, and allies (archived on the Canada Gazette).

There is also no commitment to exploring other ways to reduce barriers to the CDB, such as automatic enrolment for anyone who already receives provincial or territorial disability benefits. The current estimate for DTC applications to be approved is 15 weeks, largely due to prior cuts to the public service. Budget 2026 states AI and process automation will be used at the Canada Revenue Agency. There is no mention as to whether AI will be used in assessing DTC and CDB applications but there is reason to be cautious. A 2021 report from the Special Rapporteur on the rights of persons with disabilities flags research that revealed AI can be a gatekeeper for social protection benefits due to biased data sets and discriminatory algorithms.

Child Care

Budget 2025 fails to allocate needed funds to expand the Canada-wide early learning and child care program. It is not enough to not cut the program—further investment is needed to increase access to public and non-profit child care spaces and to address worker shortages.

While the budget maintains the funding levels previously committed to, it does not allocate additional funding that is so needed. The budget claims to improve affordability, but expanding universal public child care would be an important way to reduce the cost of living for many families, as well as contribute to a strong economy.

In their Budget 2025 press release Child Care Now noted that federal investments in child care between 2021 and now have generated major economic returns for Canada, including a significant increase in women’s labour force participation. A 2024 economic study from the Centre for Future Work found that expansion of child care services likely prevented Canada from experiencing a technical recession in the second half of 2023.

Young Workers

Budget 2025 recognizes the crisis in youth unemployment rates. Though continued investment in Canada Summer Jobs, the Youth Employment and Skills Strategy, and the Student Work Placement Program are welcome, there is no significant difference between what’s promised in Budget 2025 and what was delivered in previous years. This indicates that existing programs will not move the needle much when it comes to the youth unemployment crisis. And while the Youth Climate Corps program is an interesting idea, there are too few details to say whether it will meaningfully assist young workers.

It should be noted that all of the above are administered by ESDC which is one of several departments that has been tasked with cutting 15% over three years and is flagged for rapid AI integration. How the federal government plans to administer these programs while cutting public service jobs remains to be seen. There is also no funding in the budget for the campaign platform promise of a permanent Youth Mental Health fund which Carney stated would, “provide 100,000 young people a year with mental health care”.

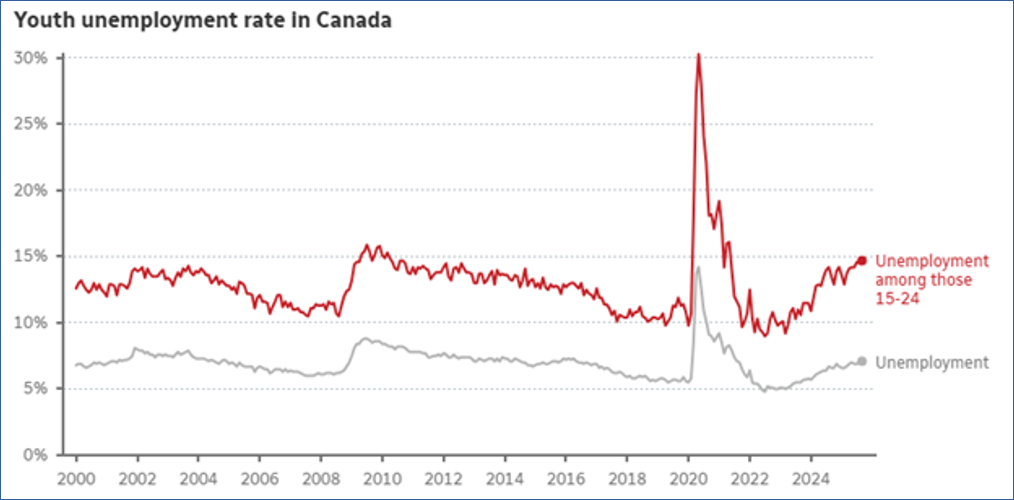

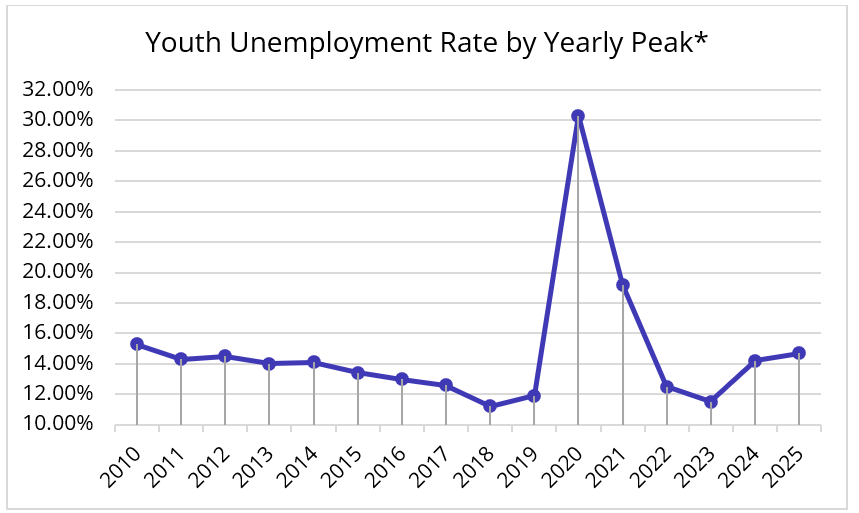

The youth unemployment gap is at the highest its been in over 20 years outside of a formal recession and the COVID-19 pandemic years. It is important to note that the following graphs only show the big picture for youth unemployment and that youth from equity-deserving groups experience even higher rates of unemployment.

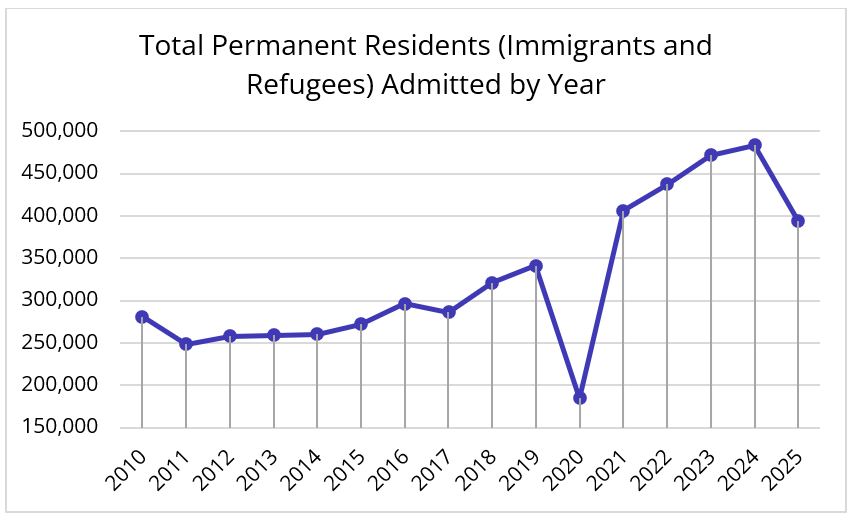

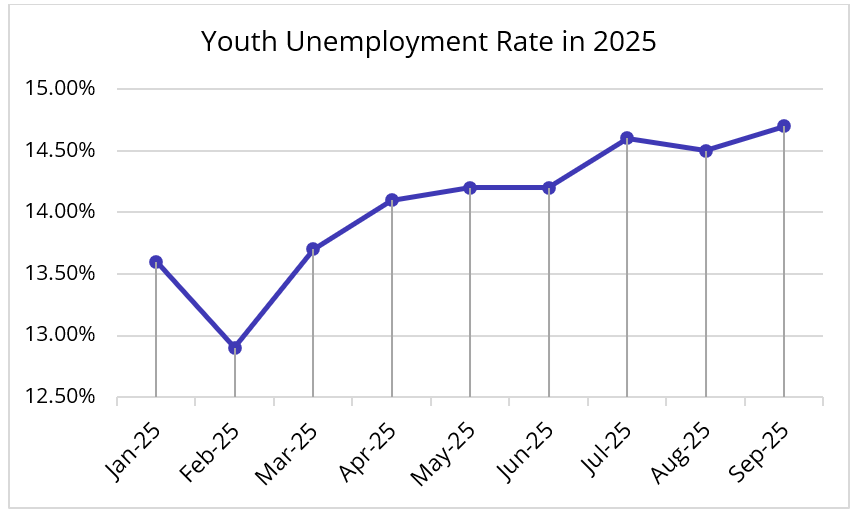

It’s also necessary to contextualize the youth unemployment crisis against the backdrop of the Canada-US trade war. The trade war and the resulting uncertainty on the labour market has a disproportionate impact on young workers, something Budget 2025 does not significantly address. The budget does however claim that “managed immigration growth is now helping to stabilise labour-market conditions and is expected to support better outcomes for youth”. But immigration and refugee data and youth unemployment data don’t appear to substantiate that claim.

* Note that only the highest level of youth unemployment per year was included for visual simplicity. The full dataset is included in the previous graph.

Between 2010-2019, immigration levels climbed while the youth unemployment rate fell. The pandemic of the early 2020s had a major impact on immigration, youth unemployment, and general unemployment. From 2022-2024 immigration levels rose significantly and youth unemployment rose slightly, though it didn’t reach the rate of youth unemployment seen in the 2010-2017 period. Immigration levels dropped sharply in 2025 for the first time since 2017 (apart from the 2020 pandemic shut-down) with only 393,500 permanent residents admitted. Budget 2025 forecasts permanent resident admission targets at 380,000 per year for three years.

But the youth unemployment data from 2025 shows that the rate continued to rise throughout the year despite the 18.64% decrease in immigration levels. The September 2025 youth unemployment rate of 14.7% was the highest since April 2010 (apart from the early pandemic years)—a year when Canada’s immigration total was only 280,681.

The government needs to get serious about the reasons behind the youth unemployment crisis—the lasting impact of the pandemic, the U.S. trade war and an uncertain economy, the growth of the gig economy, and AI automating entry level jobs—and stop scapegoating immigrants. Action Canada for Sexual Health and Rights said it best when they said, “Canada cannot call this a ‘generational budget’ while undermining the generations who will live with its consequences.”

International Aid

When looking at the budget’s international priorities, a coalition of over 100 NGOs, led by Cooperation Canada and the Canadian Partnership for Women and Children’s Health have expressed their concern over the decision to reduce Canada’s International Assistance Envelope Strategic Priorities Fund by $2.7 billion over four years. The budget also makes specific mention of “reductions in development funding to global health programming, where Canada’s contribution has grown disproportionately relative to other similar economies”. This stance undermines the 10-year commitment to global health and rights (made in 2019) where the previous federal government promised to increase global health investments to reach an average of $1.4 billion each year, starting in 2023, and recognized that, “some areas of SRHR receive less international support than they should. Canada is making efforts to advance progress in these neglected areas of SRHR. We will help the poorest and most vulnerable, including those living in fragile and conflict-affected states”.

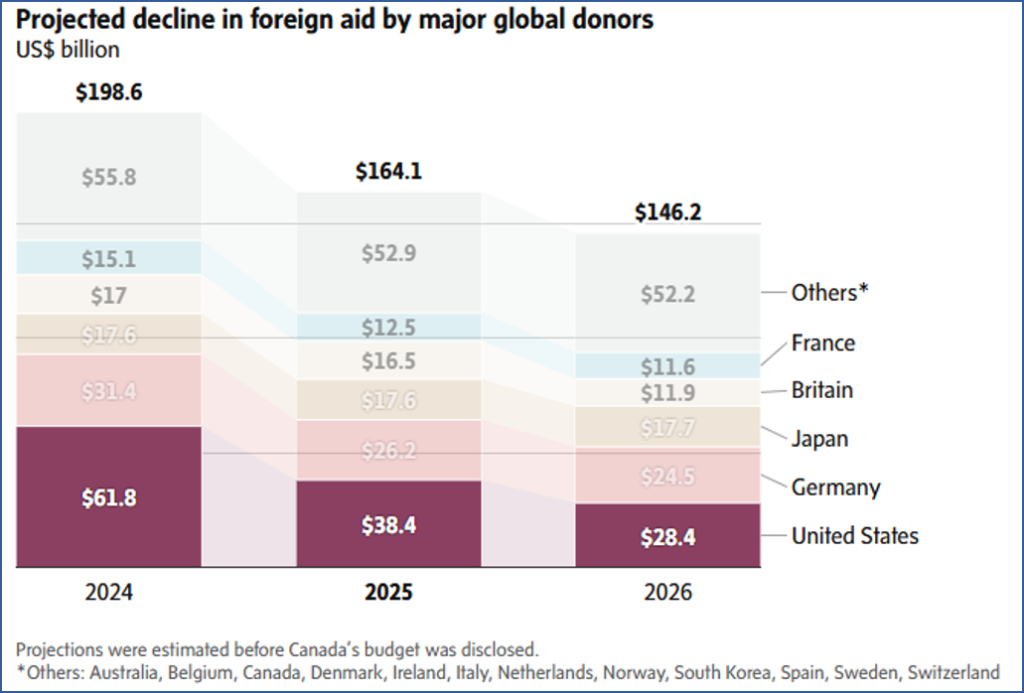

Canada’s international assistance budget cannot be examined in a vacuum. The Globe and Mail reported that G7 countries (starting with the U.S., followed by Britain, Germany, and others) have cut their international aid budgets by nearly one-third. Analysts estimate this is the steepest reduction since 1960.

The effects of these cuts will have a devastating impact on global health and will disproportionately impact women, children, racialized people, Indigenous people, people with disabilities, 2SLGBTQIA+ people, and displaced persons and refugees. Furthermore, weakening global health and security is intrinsically linked to the health and security of Canada. Experts in epidemiology, immunology, and infectious diseases warn that another pandemic is inevitable. The mass defunding of global health has the potential to speed up our trajectory towards the next pandemic and will undeniably cause preventable pain and suffering and a huge loss of human life.

It should also be noted that organizations such as Rainbow Railroad who assist 2SLGBTQIA+ refugees with fleeing persecution have flagged that major cuts to refugee resettlement programs are likely to hurt 2SLGBTQIA+ people. There is no mention in Budget 2025 of additional funding for the LGBTQI+ International Assistance Program or expanding the Rainbow Refugee Assistance Partnership, both of which were part of Carney’s “Canada Strong” campaign platform. Additionally, Immigration, Refugees and Citizenship Canada (IRCC), the department which administers both programs, is slated for 15% cuts.

Conclusion

Even with a generous interpretation, with the disproportionate benefits to middle and upper-class men, and minimal (if any) consideration for people with disabilities, Black, Indigenous, and racialized people, 2SLGBTQIA+ people, women, and newcomers, it is clear who this government is willing to leave behind as it builds a “stronger Canada”.